The Complete Guide to Customer-Based Forecasting for Subscription and Repeat-Purchase Brands

Oct 02, 2025

Introduction: When Paid Acquisition Drives the Plan

If you’re spending meaningful money on paid acquisition (Google, Meta, TikTok, affiliates), customer-based forecasting is one of the most powerful ways to project revenue. It’s especially useful for subscription and repeat-purchase businesses where growth depends on customers buying multiple times.

This method makes you think like a growth marketer: every dollar of marketing spend should have a predictable revenue outcome. With the right inputs, you’ll know how many customers you’ll acquire and how that translates into revenue this month—and beyond.

👉 This blog is part of our forecasting series, which also includes deep dives into Store-Based Forecasting, Website-Based Forecasting, Market Share-Based Forecasting, and Cohort-Based Forecasting. For a complete overview of all methods, check out our parent guide: The Essential Guide to Revenue Forecasting for Your Startup Food or CPG Business.

What is Customer-Based Forecasting?

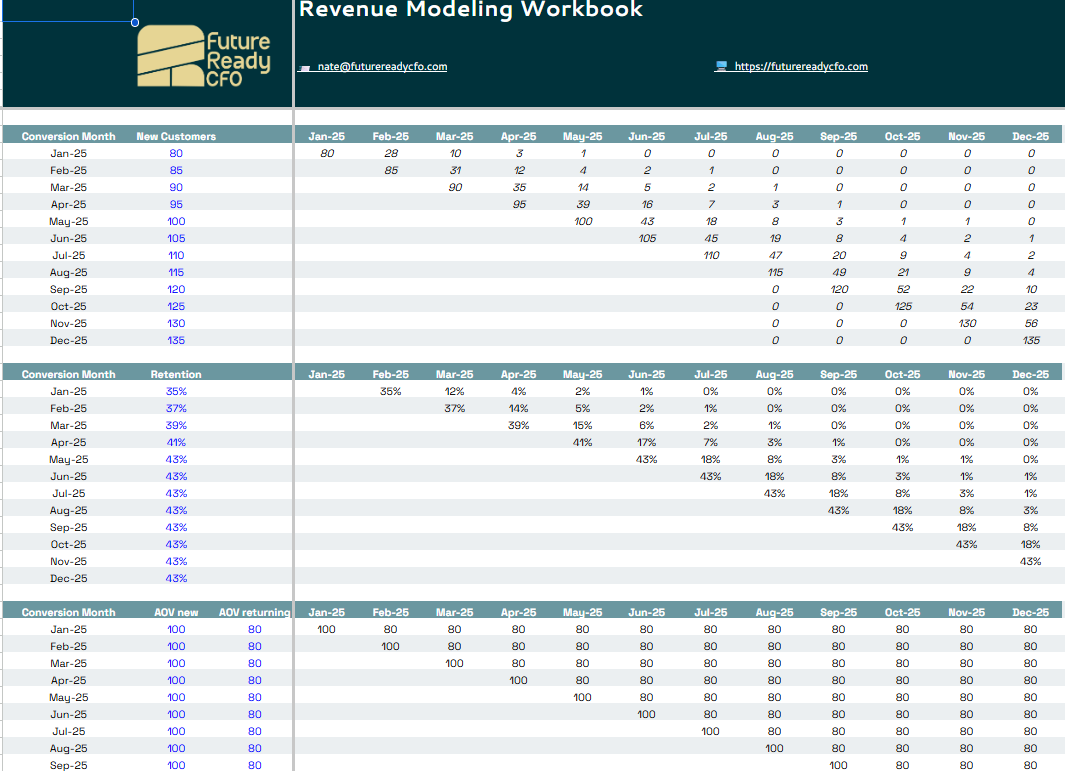

The core idea is simple:

New Customers = Marketing Budget ÷ Customer Acquisition Cost (CAC)

Revenue = (New Customers + Returning Customers) × Average Order Value (AOV)

- Marketing Budget: What you plan to spend on paid acquisition this period.

- CAC: How much it costs, on average, to acquire one customer.

- AOV: The average amount a customer spends per order.

- Returning Customers: Existing customers who come back (driven by retention).

When This Method Fits Best

- You run a subscription or repeat-purchase model and depend on customers buying multiple times.

- Your growth relies heavily on paid traffic (Google, Meta, TikTok, etc.).

- You have at least some understanding of CAC, LTV, and repeat purchase rates to ground your assumptions.

The Levers You’ll Model

- Marketing Budget

Typically increases over time as you scale spend. - CAC

- Scaling often raises CAC as audiences saturate.

- Optimization can lower CAC as your campaigns improve.

- Retention Rate

The percentage of customers who return to buy again. The higher this is, the more compounding effect you’ll see. - AOV

Start with one average, or model different AOVs if channels or products vary significantly.

How It Works (Month-by-Month)

Most customer-based forecasts are built on a monthly cadence:

- New Customers = Budget ÷ CAC

- Returning Customers = Last month’s customers × Retention %

- Total Customers = New + Returning

- Revenue = Total Customers × AOV

Because retention compounds, you’ll see revenue build each month without needing to “re-acquire” every customer.

Sample Computation

Assumptions

- Marketing Budget (Month 1): $5,000

- CAC (Month 1): $20

- AOV: $50

- Retention Rate: 30%

- Marketing Budget (Month 2): $5,250

- CAC (Month 2): $19.60

- AOV (Month 2): $51

Month 1

- New Customers = $5,000 ÷ $20 = 250

- Returning Customers = 0 (baseline)

- Total Customers = 250

- Revenue = 250 × $50 = $12,500

Month 2

- New Customers = $5,250 ÷ $19.60 ≈ 268

- Returning Customers = 30% × 250 = 75

- Total Customers = 268 + 75 = 343

- Revenue = 343 × $51 = $17,493

This shows how every marketing dollar maps to new customers, while retention compounds revenue growth over time.

Why Founders Like This Method

- Predictable per-dollar outcomes: Budget → customers → revenue are explicit.

- Retention multiplies growth: Returning customers boost revenue without proportional ad spend.

- Operational clarity: Finance and marketing can align on spend and outcomes.

Limitations to Consider

- Requires accurate CAC measurement and attribution.

- Assumes stable retention—fluctuations can shift forecasts significantly.

- Harder to use if you don’t yet know baseline CAC or repeat purchase benchmarks for your category.

Best Practices

- Model budget and CAC together to account for both scaling and optimization effects.

- Use realistic retention assumptions and adjust monthly.

- Keep it simple: one AOV works fine until complexity adds decision-making value.

- Roll up monthly forecasts into annual totals to see the bigger picture.

Conclusion

Customer-based forecasting ties your paid acquisition strategy directly to revenue and incorporates the compounding effects of retention. For subscription and repeat-purchase brands, it provides a clear, actionable framework to link marketing investment with predictable revenue outcomes.

👉 This blog is part of our forecasting series alongside Store-Based Forecasting, Website-Based Forecasting, Market Share-Based Forecasting, and Cohort-Based Forecasting methods. For a complete overview of how these models fit together, see our parent guide: The Essential Guide to Revenue Forecasting for Your Startup Food or CPG Business.

Want more like this?

Join our newsletter list and every Thursday morning you can look forward to actionable insights and free tools for scaling your brand.

We hate SPAM. We will never sell your information, for any reason.