Are you scaling an eComm or CPG brand, and constantly plagued by the feeling that you’re nearly broke?

As a fractional CFO that specializes in working with 7-figure founders, I see this problem all the time.

The source of this problem, more often than not, stems from the way we thinking about investment in inventory. In short:

- Most founders are sitting on way more inventory than they really need to operate their business

- Excess inventory means excess debt

- Excess debt means excess interest

In some cases, all this additional interest chews away at your Gross Profit to the point that there’s none left. In others, the cost of financing this inventory burden actually exceeds what the founders generate from selling the product.

Either way, the implications of this are that you are essentially working for your financier. They are collecting all the ‘economic rent’ from your efforts, and you are basically working for free.

The purpose of this blog is to

- Help you understand the sequence of events that commonly sees us fall into this trap

- Show you the financial implications of this mistake, and

- Provide you with some recommendations on how to fix it

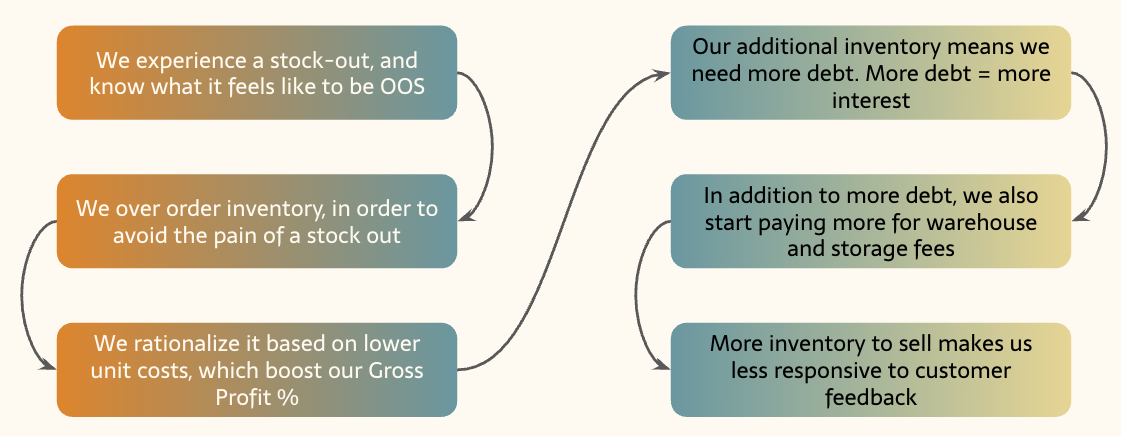

Why do founders over order inventory?

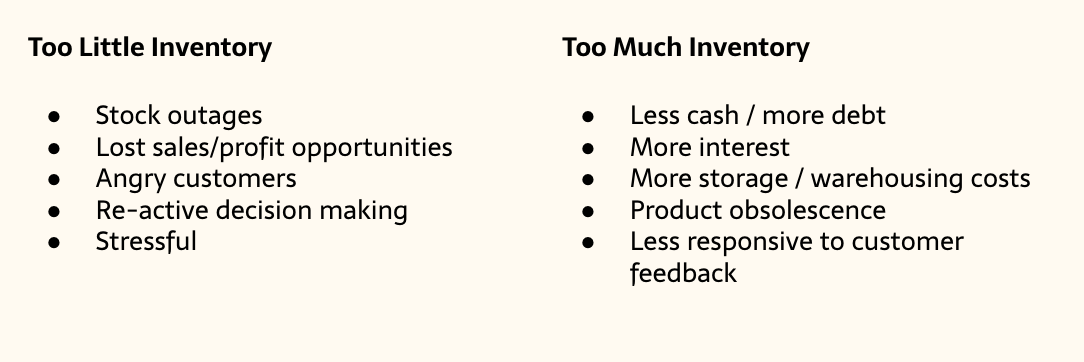

The process usually starts as a result of experiencing a stock out. After months (or years) bringing your product to live, you’ve invested hundreds or even thousands of hours into this product. So, when the inevitable sales spike or supply chain disruption occurs, and you find yourself in a situation where you have no inventory to sell you panic.

Frustration ensues. Unhappy customers. You have people wanting to buy your widget, but you’ve got none to sell. It sucks, I know.

Since you don’t want to have a repeat experience of this, next time around you decide to order more. So that you don’t run out. You justify this to yourself through the belief that you’re improving your gross profit. You see, when you order larger quantities your supplier gives you a cost break. Lower costs = higher gross margin, and that’s a good thing. Right? Well, not always.

The problem with this additional inventory is that it had to be financed somehow. And for early stage eComm brands that’s commonly done with debt. Now, for early stage businesses that have financed this inventory with a lender like Shopify Capital, Wayflyer or ClearCo, the cost of that financing could be in the 25 - 70% APR range (yes, it’s MUCH higher than the 7-9% “borrowing cost” they quote you).

The financial implications of your inventory decisions

Let’s say you have a business doing $100/month in sales. Maybe the COGS is $30/month. If this business is sitting on 9 months of inventory coverage they would have 9 x 30 = $270 inventory at any given time. If this were financed at say 40% APR, then the annual borrowing/interest cost is going to be around $108, or say $9 per month.

That $9 per month represents 9% of sales, in this example. You might be thinking ‘so what’? Well here’s why this matters. In 2024 the average EBITDA margin (Earnings Before Interest, Tax, Depreciation and Amortisation) was only about 8%. In other words, >100% of our EBITDA is being given away in the form of interest.

The table above shows what the interest costs would be for this same example business. I.e. $100/mo in revenue, $30/mo COGS, and anywhere from $2 (for 20% APR and 3 months cover) and $18/mo (for 80% APR and 9 months cover) in interest. Again, the EBITDA these businesses generate is typically only about $8/mo (i.e. 8%)

Typical Profit & Loss for 7-figure eCommerce business

Source: Finaloop & Future Ready estimates

More Than Just Financial Implications

The implications of excess inventory are more than just interest related. You’re also likely to be paying more in storage/warehousing costs, and the excess inventory also makes you more vulnerable to product obsolescence.

Say you receive some customer feedback about how to improve the product. Or you realize you need to change your packaging for compliance reasons on Amazon or in Retail. What happens if you’re sitting on a year’s worth of inventory when this happens?

- Are you going to wait a full year before shipping product with the change incorporated?

- Or will you dispose of a years worth of inventory so that you can roll the changes out sooner?

Neither are good options.

How To Optimize Your Inventory Purchasing Decisions

Once you’ve identified this problem, you’re already ahead of most founders. Well done. The next steps I recommend you take are:

- Calculate your APR (true cost of debt) and potentially also your WACC (weighted average cost of capital). This tells us how much it costs you to invest in inventory

- Audit your current inventory levels by SKU

- Calculate your average months of stock on hand, per SKU

- Once you know the average stock levels, you can imply the amount of debt needed to hold that inventory. Multiply this by the WACC or APR to get your annual financing cost of hold the inventory for each specific SKU

- Set inventory turn targets by product/category

Our goal here is to make sure that YOU get to keep the financial rewards from selling your products, rather than giving it away to a lender.

At Future Ready CFO we’ve helped dozens of 7-figure founders get out of this mess, and build systems to help them operate more efficiently - in doing so improving cash flow, increasing products, and most importantly of all - reducing founder stress!

If you’d like to learn more about how we could help you do the same, either sign up to our newsletter or book a free discovery call here.

Want more like this?

Join our newsletter list and every Thursday morning you can look forward to actionable insights and free tools for scaling your brand.

We hate SPAM. We will never sell your information, for any reason.