Fractional CFO for Ecomm & CPG Brands.

Built for Scale.

We bridge the gap between 'keeping the books' and 'growing the business', by providing the specialized financial oversight you need to master your inventory, protect your margins, and fuel your growth.

When financial complexity clouds decisions and stalls your momentum, we're the operational upgrade that moves you forward.

BOOK YOUR DISCOVERY CALL HERE

From Financial Uncertainty to Total Founder Confidence

Before: The Growth Bottleneck

-

Revenue is growing, but cash always feels tight

-

Inventory ties up capital at the worst possible times

-

You don’t know which SKUs actually fund the business

-

Hiring and ad spend feel like guesses

-

Your dashboards show loads of numbers, but are not helping you make decisions

You’re not bad at business.You’re just missing a financial lens built to make sense of the numbers.

After: Proactive Financial Control

-

Clear cash flow and profitability forecasting, that reflects the realities of running an inventory-heavy business

-

Clarity on revenue and profitability per SKU and per channel - so you can know what’s working, and what’s not

-

Decision making support for all the stuff that keeps you up at night - hiring & firing, managing PPC budgets, product and channel expansion decisions.

-

A simple financial rhythm you can actually maintain

No overwhelm. Just the information you need to lead with confidence.

Trusted by PURPOSE-LED ECOMM & CPG FOUNDERS

Built for founders managing inventory, growth, and real-world margins

Strategy-first financial guidance - not generic dashboards

Our fractional CFO work follows a simple, proven strategic roadmap:

1. Transparency

You can’t fix what you can’t see. The first step in all our engagements is setting you up with data and dashboards that empower you to understand what’s going on inside your business.

2. Priorities

We’ll take time to understand your goals, and what you’re working towards. Looking for an eight figure exit? Want to build a lifestyle business? Or perhaps you just need to pay yourself consistently. We understand your short and near term priorities so we can build a strategy that supports them.

3. Focus

Once we understand where you’re at right now, and where you want to get to, we’ll help you prioritize and get laser focused on the 2-3 things that are really going to move the needle for you and your business.

4. Implementation

Think of us like your ‘co-founder on demand’. We just happen to be a cofounder that’s really good at finance and data. We’ll help connect you with the people, tools and technology you need to help achieve your goals.

This isn’t about perfect numbers.

It’s about better decisions.

Here’s our promise:

-

Predictable cash flow instead of constant surprises

-

Less vulnerable to shiny objects, more focused on the things that move the needle

-

Feeling empowered and enlightened by their financial statements, instead of overwhelmed or confused

-

Less stress, more clarity and confidence

This is what financial clarity feels like.

GET CLARITY NOW, BOOK YOUR DISCOVERY CALLWhat happens during our Discovery Call

-

This isn't a sales pitch - it's a high-level conversation designed to understand the road blocks and friction points that are holding you back.

-

Audit Your Financial Stack: if it seems like we are a mutual fit, we'll tell you about our Financial Review process and what the next steps are.

-

Custom Roadmap: We define a scope centered on your specific goals, whether that’s an exit, a Series A, or sustainable profitability.

Our Promise: We’ll either map out a clear path for partnership or point you toward the resource that fits your current stage better.

Real founders. Real wins.

Hi, I’m Nate!

Founder of Future Ready | Fractional CFO | Ex-Founder | Wall St. Escapee

I’ve been where you are - running a mission-driven brand, wearing all the hats, and wondering why the numbers still don’t add up.

Before launching Future Ready, I built my own eComm startup from a $40K Kickstarter to a 7-figure business. I’ve sat in the founder seat, and I know how lonely it can feel when the numbers get messy.

Earlier in my career, I spent nearly a decade on Wall Street, analyzing financial statements, spotting patterns, and learning to read data like a story. That’s what I bring to founders today: the ability to make sense of the mess, build smart systems, and lead with confidence - without losing sight of purpose.

Through 1:1 support, group programs, and free tools, I help purpose-led brands get financially Future Ready.

📍 Based in Brooklyn. Always down to swap founder stories over coffee (or spreadsheets).

-Nate Littlewood

You’ve got some questions, we have the answers:

1. What exactly does a fractional CFO do that my bookkeeper doesn't?

2. How is this different from just using financial software or dashboards?

3. What size revenue do you typically work with?

4. How much time commitment does this require from me?

5. Do I need to switch accounting software or systems?

6. What's the typical engagement length and cost?

7. I'm thinking about raising capital or selling my business. Can you help with that?

8. What if I'm not ready for a fractional CFO yet?

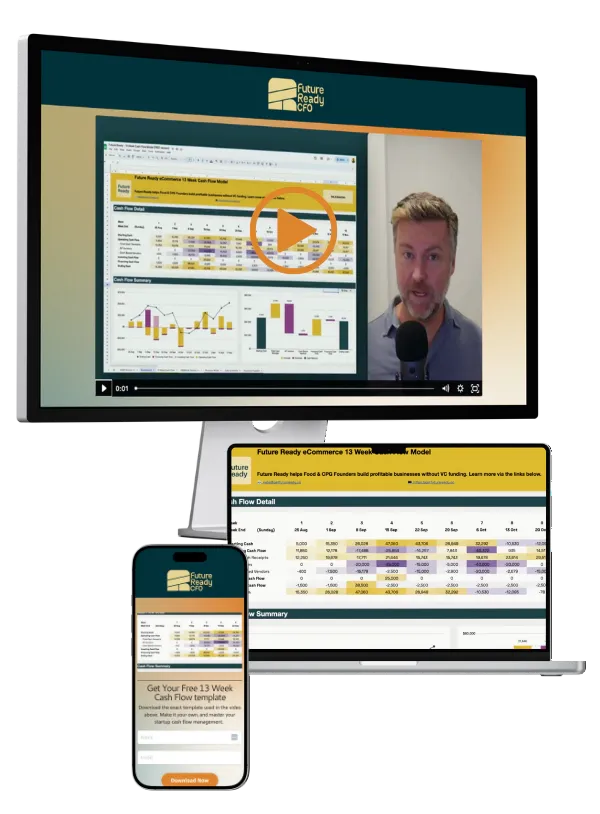

sign up and Get Your Free 13 Week Cash Flow template

Signup to download the template and view the video. Make it your own, and master your startup cash flow management.

What's included?

• Free 13-Week Cash Flow Template to track and manage your finances

• Step-by-step video guide showing you how to use the template

• Clarity on balancing payroll, inventory, and marketing expenses

• A customizable tool tailored to your business needs

• A proven method to help you avoid cash shortages